Contents

However, the reversal might not start as soon as the hanging man pattern is formed. In contrast, it generates a message that the current market momentum is in the closing stage, and the price action is preparing for a potential change in the trend direction. Candlesticks display the high, low, opening, and closing prices for a security for a specific time frame. Candlesticks reflect the impact of investors’ emotions on security prices and are used by some technical traders to determine when to enter and exit trades.

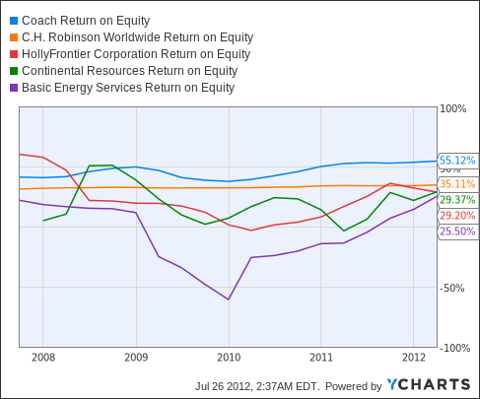

The chart below shows two hanging man patterns in Meta , formerly Facebook stock, both of which led to at least short-term moves lower in the price. The long-term direction of the asset was unaffected, as hanging man patterns are only useful for gauging short-term momentum and price changes. No need to issue cheques by investors while subscribing to IPO.

A more aggressive strategy is to take a trade near the closing price of the hanging man or near the open of the next candle. Place a stop-loss order above the high of the hanging man candle. The following chart shows the possible entries, as well as the stop-loss location. If it’s an actual hanging man pattern, the lower shadow is at least two times as long as the body. In other words, traders want to see that long lower shadow to verify that sellers stepped in aggressively at some point during the formation of that candle.

Technical Classroom: What is Hammer & Hanging Man candlestick pattern?

On the other hand, a Shooting Star Pattern has a small real body near the bottom of the candlestick and is accompanied by a lower upper shadow. It can also be said that a shooting star is a flipped hanging man. However, in both cases, the length of the shadow should be at least twice the height of the real body. The hanging man patterns that have above-average volume, long lower shadows, and are followed by a selling day have the best chance of resulting in the price moving lower.

- Today, we will be discussing about Hammer and Hanging Man candlestick patterns.

- Many banks have surpassed analysts’ profit estimates; even if a few have announced losses or smaller profits, that’s primarily on account of one-off deferred tax asset adjustments.

- The opposite holds for bearish hanging men—you can use them to time your sales.

- You may also get to see the gap up opening before the hanging man.

- Just write the bank account number and sign in the application form to authorise your bank to make payment in case of allotment.

- In contrast, it generates a message that the current market momentum is in the closing stage, and the price action is preparing for a potential change in the trend direction.

Like any investment, there is a possibility that you could sustain losses of some or all of your investment whilst trading. You should seek independent advice before trading if you have any doubts. Past performance in the markets is not a reliable indicator of future performance. The main difference between a red and green hanging man candlestick pattern is that in a green hanging man candlestick, prices decline below both of their previous lows.

Inverted Hammer Candlestick Pattern

Thomas Bulkowski’s “Encyclopedia of Candlestick Charts” suggests that the longer, the lower shadow, the more meaningful the pattern becomes. Using historical market data, he studied some 20,000 hanging man shapes.1 In most cases, those with elongated shadows outperformed those with shorter ones. Of the many candlesticks he analyzed, those with heavier trading volume were better predictors of the price moving lower than those with lower volume.

It states that the investor’s interest in the stock is waning, and they must be ready to sell the security, which will decrease the price of the stock. Instead, it gives out a message that the current rate is in its closing stages as the price action is all set to future change in the direction of the trend. The bulls were trying to keep the prices stable but the bears have pulled the prices downwards. However, in the end, the bulls tried to push the price upwards and managed to close the candle near the open. Do not trade in “Options” based on recommendations from unauthorised / unregistered investment advisors and influencers. The same happens here with hanging candlestick pattern as well.This pattern can be used as an entry point.

When the hanging man is seen as “T,” the candle appears only as a warning and doesn’t require any reason to act. Reproduction of news articles, photos, videos or any other content in whole or in part in any form or medium without express writtern permission of moneycontrol.com is prohibited. We at Enrich Money do not provide any stock tips to our customers nor have we authorised anyone to trade on behalf of others. If you come across any individual or organisation claiming to be part of Enrich Money and providing such services, kindly intimate us immediately. Check your securities / MF / bonds in the consolidated account statement issued by NSDL/CDSL every month. Stock brokers can accept securities as margins from clients only by way of pledge in the depository system w.e.f September 01, 2020.

The pattern becomes more bullish as the lower shadow grows longer. Let’s suppose there is a chart that showcases the decline of price after a short-term increase in prices where the hanging man candle appears. Following the hanging man, the price https://1investing.in/ declines on the next candle, giving the needed confirmation to complete this pattern. After or during the confirmation candle, traders can enter the short trades. Often, the general candlesticks and the hanging man are not used in isolation.

Invest wise with Expert advice

Third, it should have very little upper wick; if there is any upper wick at all then it’s not hanging but more like ‘dipping’. As you read the next two paragraphs, try to visualise why the Hanging Man candle gets formed. Please note that by submitting the above mentioned details, you are authorizing us to Call/SMS you even though you may be registered under DND. We do not sell or rent your contact information to third parties. Please note that by submitting the above-mentioned details, you are authorizing us to Call/SMS you even though you may be registered under DND. Pay 20% or “var + elm” whichever is higher as upfront margin of the transaction value to trade in cash market segment.

Typically, traders wait for the second candle to close before moving on the pattern. Once a bearish engulfing pattern appears, one can take several actions, such as selling a long position or possibly opening a short one. Another essential type of candlestick that you must know about is the hanging man candlestick pattern.

The Ultimate Guide to Swing Trading Strategies

The candle has a small real body, no or little upper shadow, and a long lower shadow. The stock opens on the second day of the pattern near the P1 closing values and tries to set a new bottom. The prices do, however, close lower than they opened the previous day since there is more selling interest at this low point of the day. It is stronger to see a down candle that is significantly larger than an up candle than vice versa. At the peak of an upward trend, a single candlestick pattern known as the Hanging Man formation heralds a probable change in trend direction. Although the Hammer and Shooting Star are comparable to this candlestick, there are several significant variances in price direction and shape.

Bearish Hanging Man candles form quite often so you want to use other indicators to verify potential moves. The bearish version of the Hammer is the Hanging Man formation. A hanging man is a type of bearish reversal pattern, made up of just one candle, found in an uptrend and can act as a warning of a potential reversal downward. A longer lower shadow indicates that the sellers entered the market aggressively when the formation in the candle took place. More meaning and depth is added to the candlestick with a long lower shadow in the hanging man candlestick pattern.

Look for increased volume, a sell-off the next day, and longer, lower shadows and the pattern becomes more reliable. Utilize a stop loss above the hanging annuity table pv man high if you are going to trade it. Another distinguishing feature is the presence of a confirmation candle the day after a hanging man appears.

By combining this pattern with other patterns and indicators, you can create your own trading strategies. For any group of stocks and market segments, you can scan and backtest stocks based on those strategies. Even though the candlestick pattern offers a strong signal for the market to move downwards, you should not act out on the basis of this candlestick alone. It would be better if you refer to experienced people or use technical indicators to confirm the reversal before making a move. As mentioned, price tags are missing in a hanging man candlestick pattern.